AUGUST / JANUARY INTAKE

18 Months Full-Time (with flexibility to complete in 12 months)

30 Months Part-Time (with flexibility to complete in 24 months)

APPLICATION CLOSES:

August Intake: 30 June 2026

January Intake: 16 November 2026

TUITION FEE:

S$54,500 Tuition Fee (inclusive of GST)

For 1-1 consultation, please contact our admission consultant here.

Click here to sign up now for SMU Economics Masters online information session on 26 February and learn more about applications for August 2026 intake!

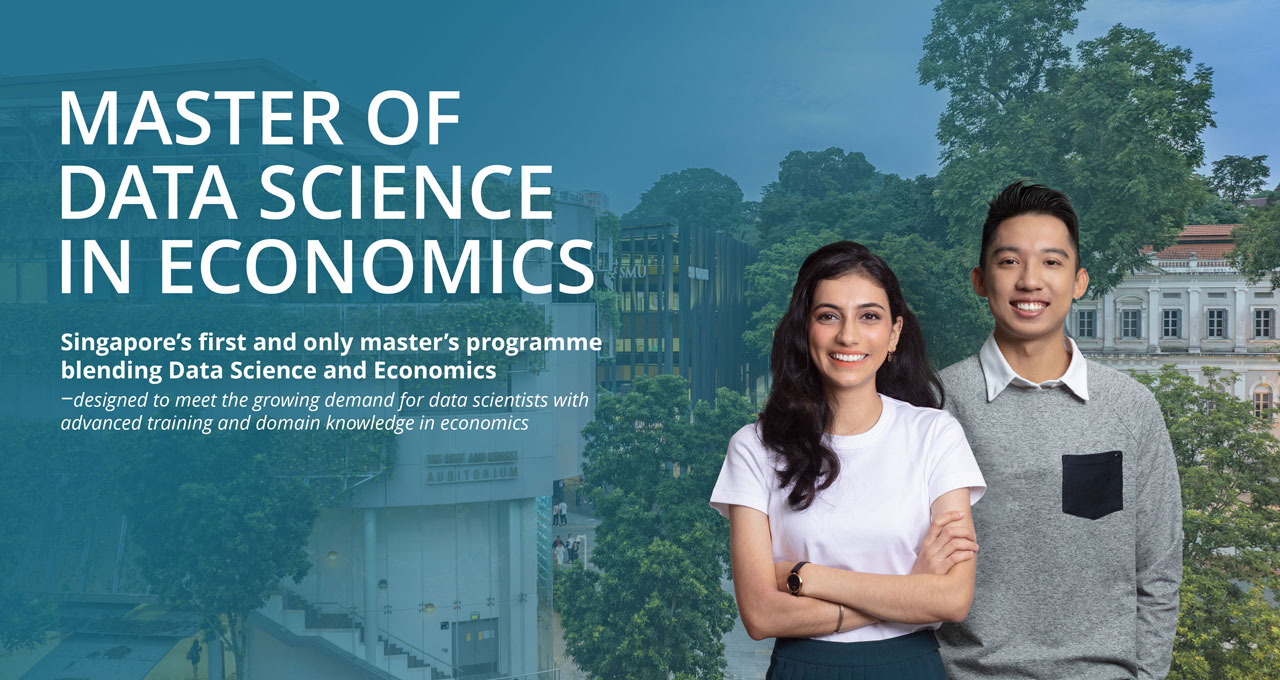

About The Master of Data Science in Economics

Economic data are generated at high volume, velocity, and variety. As companies collect ever-increasing amounts of data, those who can effectively extract value from it will come out on top.

Discover the power of data with a Master of Data Science in Economics (MDSE) from the School of Economics at Singapore Management University.

Why Pursue MDSE?

-

1

Learn industry-relevant programming languages:

Gain proficiency in Python, SQL, and R — three of the most in-demand languages for data science.

-

2

Turn data into insights:

Master the skills needed to query, analyze, and model large-scale economic data using distributed computing techniques on both on-premises and cloud clusters. Apply statistical models and machine learning algorithms to generate explainable predictions, accurate classifications, and actionable recommendations.

-

3

Sharpen your competitive edge:

Equip yourself with the skills needed for the future of work, including expertise in big data technologies such as Apache Hadoop, Apache Spark, and Apache Cassandra. Stay ahead with current knowledge and practical skills necessary to tackle data-driven challenges, through talks and workshops delivered by industry practitioners.

-

4

Apply your skills in real-world projects:

Develop the ability to effectively communicate your results to project stakeholders by documenting and explaining your analysis to both technical and non-technical audiences. Showcase your work on GitHub and GitHub Pages, and build a portfolio of projects to demonstrate your skills to prospective employers.

Testimonials

Industries MDSE Graduates Will Work In

-

Financial Services

Financial Services -

Government

Government -

Technology

Technology -

Healthcare

Healthcare -

Consulting

Consulting -

Telecommunications

Telecommunications

Programme Details

Programme Calendar

AY2026-2027: Click here to download

Programme Structure

The Master of Data Science in Economics (MDSE) is a multi-disciplinary programme with a unique curriculum that equips you to analyze economic issues more effectively by combining the strengths of artificial intelligence (AI), machine learning (ML), and econometric methods. The MDSE stands out for its strong industry relevance and hands-on learning approach.

(Full-time and Part-time)

Full-time January Intake

Part-time January Intake

Term

Term

Term

Term

Term

Term

Term

Term

Term

Term

Term

Term

Term

Term

(Full-time and Part-time)

Full-time August Intake

Part-time August Intake

- Students may graduate as soon as they have met all requirements, even if this is earlier than the expected completion dates indicated above. The maximum candidature is 2.5 years for full-time students and 4 years for part-time students.

- Part-time students typically take 1–3 CUs per regular term (Aug, Jan, Apr), whereas full-time students take 2–5 CUs.

Programme Information

The MDSE programme features a 15-CU curriculum with internship opportunities that equip students with advanced, up-to-date knowledge and skills in data science for economics.

Each course unit (CU) comprises ten 3-hour sessions. Graduation requires a Cumulative Grade Point Average (CGPA) of at least 2.50 on a 4.00 scale.

Foundation (2 CUs)

The Foundation component is designed to equip students from non-technical backgrounds with essential training in probability theory, statistics, and programming. Students with strong technical knowledge may be exempted from this component.

| MDSE Programme Foundation |

|

Probability for Data Science |

Core (6 CUs)

The Core component equips students with rigorous training in programming, statistics, data analytics, data management, AI, ML, and econometrics. Students with strong technical knowledge may be exempted from up to 2 CUs in this component.

| MDSE Programme Core |

|

Applied Causal Inference |

Elective (3 CUs)

MDSE students have the flexibility to select 3 electives, allowing them to expand their expertise in specialized areas.

| MDSE Programme Elective |

|

Advanced Machine Learning for Economics |

Note: Not all courses are offered every year. Course titles and content are subject to change, and new courses may be added from time to time.

Open (3 CUs)

To enhance their academic experience and holistic development, MDSE students can choose to complete a 10-20 week internship (1-2 CUs), undertake a Capstone project (1 CU), and take up to 3 pre-approved electives from other SMU Master’s programmes, such as the MSE and MSFE.

Postgraduate Professional Development course (1 CU)

Students are required to complete a series of full-day, skills-based, developmental workshops or experiential components facilitated by SMU faculty and experienced trainers from various industries. These activities enhance students’ professional standing, help them acquire new skill sets beyond the curriculum, and expand their network with fellow students across SMU’s Master’s programmes.

FOUNDATION COURSES

The purpose of this course is to develop a solid understanding of fundamental probability theory for quantitatively assessing uncertain events. Each teaching topic focuses on the practical applications of probability concepts in fields such as economics, finance, actuarial sciences, and risk management.

Topics covered include: an overview of probability, random variables (discrete, continuous), probability distributions, mathematical expectation, functions of random variables, sampling distributions, jointly distributed random variables, the likelihood function, stochastic processes, and more.

This course uses Python and/or R. No prior programming experience is required.

This course provides students with a rigorous and comprehensive foundation in modern, data-driven statistical modelling, bridging classical statistical theory with contemporary machine learning methods and emphasising the principles that govern predictive modelling, inference, and reliable performance on new, unseen data. Programming is integrated throughout the course.

Designed for students in data science, applied economics, and related quantitative disciplines, the course aims to develop statistical literacy, computational proficiency, and the critical evaluation skills needed to analyse rich, real-world datasets and construct reliable predictive models.

Topics include: experimental design, ethics, and random sampling; parametric statistical modelling; goodness-of-fit tools (QQ-plot, PP-plot, Kolmogorov–Smirnov test); nonparametric methods (kernel density estimation, empirical distribution); foundational statistical inference (confidence intervals, hypothesis testing, A/B testing); supervised and unsupervised learning; regression (simple and multiple linear regression); classification (logistic regression, naïve Bayes, generalised linear models); distinguishing between explanatory and predictive models—and knowing when to use each; the bias–variance trade-off; resampling methods (cross-validation, bootstrap); linear model selection (best subset, stepwise selection); and regularisation methods (ridge regression, LASSO, Elastic Net).

CORE COURSES

Causal inference encompasses tools that allow economists to determine what causes what. This course introduces students to methods from traditional econometric theory and modern machine learning, required to obtain meaningful answers to questions of causation. Using examples and data from economics (such as the effects of product price on sales volume, college on earnings, increases in the minimum wage on employment, and early childhood education on later incarceration) and the Python programming language, students will gain practical skills and theoretical understanding.

Topics covered include: design of experiments, review of probability and regression, structural equation models (SEMs), directed acyclic graphs (DAGs), structural causal models (SCMs), difference-in-differences, regression discontinuity designs, and more.

This course assumes basic proficiency in Python.

This course provides an introduction to fundamental concepts, techniques, and tools in data analytics. Students will learn how to analyze data to extract meaningful insights, make data-driven decisions, and solve real-world problems using the Python programming language. Special emphasis is placed on examples involving data from economics, finance, and actuarial science.

Topics covered include: an overview of data analytics, composing data graphics, the general steps of a data analysis project (import, wrangle, visualize, model, communicate), Quarto, GitHub and GitHub Pages, combining multiple tables, tidy data principles, web scraping, data cleaning, exploratory data analysis (EDA), feature engineering, application programming interfaces (APIs), D3, interactive data graphics, dashboards, web apps, and more.

This course uses Python and may also include R. No prior experience is required.

This course provides an introduction to the fundamental concepts and principles of modern database management systems (DBMS). Through a balanced blend of theoretical foundations and practical skills, students will learn to design, implement, and manage databases efficiently. On completion of the course, students will possess a comprehensive understanding of database architecture, data modeling, query languages, and database administration techniques. Special emphasis is placed on examples and data from economics and finance (such as tick data, receipts, emails, and social media data).

Topics covered include: overview of data management systems, the relational model and relational database concepts, database design and implementation, database querying with Structured Query Language (SQL), exploring the limits of SQL, handling structured, semi-structured and unstructured data, distributed databases, introduction to Not Only SQL (NoSQL), types of NoSQL databases (document, key-value, column-family, graph), database administration best practices, connecting to and working with SQL and NoSQL databases in Python, ETL, and more.

This course uses SQL. No prior experience is required.

This course provides an overview of Machine Learning (ML) principals. The goal of the course is to teach you the basics of the ML theory and practice of ML algorithms. The course will build upon the knowledge and skills you gained in econometrics and statistics courses. Students will learn how to interpret, design, and execute empirical projects using software and skill building in critical thinking and problem solving will also be emphasized. We will additionally explain important issues and topics that recently happened in the ML literature.

The purpose of this course is to introduce students to modern applied statistics, with a primary focus on data analysis.

Topics covered include: a review of probability theory, the law of large numbers (LLN), the central limit theorem (CLT), point estimation (method of moments, maximum likelihood), properties of point estimators (unbiasedness, consistency, efficiency), descriptive statistics, skewness and kurtosis, Monte Carlo simulation, numerical optimization, hypothesis testing, A/B testing, confidence interval estimation, nonparametric methods, and more.

This course uses Python and may also include R. No prior experience is required.

This course covers models used in the econometric analysis and forecasting of economic time series, particularly macroeconomic time series. The models covered include stationary and non-stationary autoregressive moving average models, autoregressive distributed lag models, error correction models, vector autoregressions, and vector error correction models. Topics include correct inference and interpretation of model parameters, model selection, structural change, and forecasting, forecast uncertainty, and forecast evaluation.

ELECTIVES COURSES

This course introduces more advanced machine learning methods applicable in economics, finance, risk management, and actuarial science.

Topics covered include: supervised and unsupervised learning, principal components analysis (PCA), recommender systems, gradient descent, K-means clustering, hierarchical clustering, principal component regression, partial least squares (PLS), regression splines, generalized additive models (GAMs), bagging, random forests, boosting, Bayesian additive regression trees, support vector machines (SVMs), neural networks (deep learning), and more.

This course uses Python and may also include R.

In this course, students will explore big data analytics using the powerful framework of Apache Spark, with a focus on PySpark, the Python API for Spark. Through a hands-on approach, students will develop practical skills in handling large-scale data, perform statistical analysis, and apply machine learning techniques. Special emphasis is placed on examples and data from economics and finance (such as tick data, emails, IoT data, and social media data).

Topics covered include: sources of big data, structured, unstructured and semi-structured big data, big compute and parallel computing, data wrangling, exploratory data analysis (EDA), machine learning (ML), clusters, Hadoop (HDFS, MapReduce), Spark (RDD, Spark SQL, MLlib, Structured Streaming), feature engineering, training and testing statistical models (supervised and unsupervised learning), Spark ML Pipelines (operating modes, interoperability, deployment).

Python is used throughout the course.

Cloud computing is the backbone of modern analytics applications. Cloud platforms like AWS offer scalable, on-demand infrastructure for storing, processing, and modelling large volumes of data.

This course introduces students to modern cloud platforms - especially Amazon Web Services (AWS) - that power real-world analytics applications. Through this course, students will gain hands-on experience in developing end-to-end analytics applications.

Topics include: cloud concepts; cloud economics and billing; AWS global infrastructure; cloud security; networking and content delivery; compute services (EC2 and Lambda); storage solutions; databases (relational and NoSQL); developing end-to-end analytics applications; and applying cloud architecture best practices to ensure scalability, performance, and security.

This course welcomes students from diverse backgrounds with some exposure to data analytics. While experience with Python, SQL, or the AWS Cloud can be helpful, all key concepts will be introduced from first principles.

This course explores the foundational concepts and techniques for analyzing complex networks, with a special emphasis on examples from economics and finance (such as business model design, market analysis, and developing user growth strategies).

Topics covered include: graph theory, distance and centrality measures, clustering, random network models, social networks, exploration, analysis, and visualization of complex networks, and more.

Python is used throughout the course.

This course is designed to give students a thorough understanding of high-frequency trading (HFT)—the use of sophisticated algorithms and high-speed technology to execute trades in milliseconds. The course covers the evolution of HFT, explores the technological infrastructure required for low-latency trading, and teaches various HFT strategies such as market-making, arbitrage, and momentum trading.

Students will also investigate the impact of HFT on market liquidity, price discovery, and volatility, while considering the regulatory landscape that governs high-speed trading.

Group Project topics are related current industry practices. Through practical programming exercises, case studies, and simulations, students will develop the ability to design and evaluate HFT strategies, leveraging Python for algorithmic execution.

This course explores various techniques for the analysis of text, audio, images, and videos. Special emphasis is placed on examples and data from economics and finance (such as satellite imagery, earnings calls transcripts and recordings, CEO and Executive interviews, financial news, and social media data).

Topics covered include: natural language processing (NLP), sentiment analysis, text classification, speech recognition, image processing, face detection, face recognition, and more.

This course uses Python and may also include R.

This course introduces econometric models and methods for analyzing panel and longitudinal data that arise from repeated measurements taken from a cross-section of units. These models have found substantive applications in social and biological sciences where the describer “panel” and “longitudinal” respectively arose. This course is primarily oriented to the applications in social sciences including business, economics, education, sociology, etc. Theories are presented lightly without much hustle of derivations and Python codes are provided for real world applications. Major topics include (i) panel data models with fixed effects; (ii) panel data models with random effects, (iii) panel data models with heteroskedasticity and serial correlation, (iv) tests of hypotheses with panel data, (v) cluster robust standard errors, (vi) two stage least squares and instrumental variables estimation, (vii) dynamic panel data models, and (viii) forecasting with panel data. Throughout, we emphasize on applications of panel data models and methods with Python, a dominant software package in data science, machine learning, and artificial intelligence, and an ideal software package for learning econometrics and data analysis.

A good understanding of Parts I & II of Wooldridge (2019). Introductory Econometrics: A Modern Approach, 7th Ed, would be sufficient for the learning of this course.

This course includes concepts and tools used in econometric modelling and statistical analysis of spatial data: data on attributes that are correlated in ‘space/location’ (a.k.a. geo-tagged data). Spatial data are commonly used in regional science and urban economics (related to property prices, crime, household income, etc.), epidemiology and public health (such as disease clusters, etc.), environmental science (climate change, air pollution, ozone density, etc.), ecology, biology, geology, social interactions and network effects, and other disciplines.

We will start the course by looking at practical aspects of organising and visualising spatial data. We will also discuss how to use a coordinate reference system to give spatial awareness to a dataset and make meaningful maps – the main visual aid for spatial data. Then we will consider the statistical and econometric aspects behind spatial data analysis with a special focus on how to re-align classical statistical and econometric techniques towards spatial data for the three broad types of spatial data: (i) point patterns, (ii) areal data and (iii) geostatistical data.

Exploratory spatial data analysis methods, including various plots and tests for spatial autocorrelation, are discussed. Diagnostic tests for complete spatial randomness against spatial clustering or dispersion is an important step in the initial stages of exploratory spatial data analysis. Point pattern analysis and different methods used to measure the degree of spatial autocorrelation will also be discussed. Spatial econometric models and estimation will be discussed in terms of areal data. Spatial econometric models and methods are effective in modelling spatial dependence and thus useful in predicting attributes that are affected/related to its’ neighbours. We will focus on the main spatial regression models (spatial lag, spatial error, and spatial Durbin) with and without heteroskedasticity. The usual estimation techniques, quasi-maximum likelihood and GMM methods are discussed for model estimation and inferences. The course will end by discussing main methods of interpolation techniques used in spatial data analysis.

Applications of these techniques using R will be presented throughout the course including application examples on the assessment of climate change risks, spread of COVID cases and other diseases, economics of agglomeration, etc.

Prerequisites include probability theory, inferential statistics, and econometrics at an undergraduate level. Knowledge of R programming is useful but not required.

This course offers a comprehensive introduction to the economics of “Big Tech,” exploring the growing influence of economic principles in major technology companies such as Amazon, Meta, Netflix, and Uber. As economists increasingly shape strategic decisions within these firms, their unique skill set has become invaluable. The course highlights how economists’ expertise in market dynamics and causal inference complements the technical prowess of data scientists, creating a powerful synergy in the tech industry. Moreover, their deep understanding of incentives and economic systems proves crucial for organizations navigating the complex digital marketplaces and platforms of today’s world. Through a series of real-world business cases, students will examine how economic principles drive key business outcomes in the tech sector.

Topics covered include: pricing strategies, ad incrementality and effectiveness measurement, personalization algorithms and their economic impact, logistics optimization for efficiency and cost reduction, the design and analysis of online A/B testing, and more.

This course is designed to be accessible to students from diverse backgrounds, requiring no prior knowledge of economics or programming.

This course covers specialized topics in data science relevant to economics, equipping students with current knowledge and practical skills to address real-world, data-driven challenges. Students will explore tools, applications, and insights across multiple areas of data science. Topics are delivered by industry practitioners, potentially in an online format.

Tentative topics include: data discovery, storytelling, and innovation; large language model (LLM) fundamentals; when and how to use generative AI (GenAI); building retrieval-augmented generation (RAG) systems and deploying to production; evaluating AI systems; business intelligence (BI); agentic AI; preparation for a first data science role; navigating a career in data science; and related emerging topics.

Full-time students are required to complete a minimum 10-week internship during the April Term. If you are unable to take a credit-bearing internship, you may seek approval from your Academic Director to arrange an equivalent replacement (e.g., a Capstone Project or electives).

Students who have accumulated, or will have accumulated, two years of relevant work experience by their graduation date may be exempted from the internship requirement, subject to approval.

SMU School of Economics is internationally recognised as a leading centre for economic research. Our research programmes aim to attract the very best students and help them develop into first-rate researchers, educators, policy makers, or private sector analysts. To this end, the PhD and MPhil in Economics programmes are designed to meet the highest academic standards and enable students to work closely with our world-class faculty throughout their studies.

For more information about the SMU MPhil & PhD in Economics programmes, please click here.

Events

How to Apply

- Application Period

- General Instructions

- Supporting Documents

- Admission Requirements

- GMAT/GRE/SMU Admission Test

APPLICATION PERIOD

The application periods for the respective admission intakes are as follows:

| INTAKE | APPLICATION PERIOD |

|

August |

1 October - 30 June |

|

January |

1 October - 30 September |

How to Submit Your Application

- Complete the online application form.

- Upload your supporting documents via the application portal.

- Make a payment of S$100 (inclusive of GST) for the application fee.

- You will receive a confirmation email upon successful submission of your application. Both your referees will also receive an auto-generated email with instructions to complete the referee reports. (You may wish to inform them in advance.)

- Shortlisted applicants with complete application records will be contacted for an admission interview.

If you wish to submit additional documents (e.g., latest academic transcript, new test results) after submitting your application, you may send them separately via email to mdse@smu.edu.sg

Applicant Self Service

After submitting your application, you may use the Applicant Self Service portal to perform various functions when needed (e.g., make payment for the SMU Admission Test, check your application status, update referee details, and track referee report submissions). Please refer to the Self Service Guide for more information.

The application portal will prompt you to upload your supporting documents online. Please upload them in PDF format where possible. Ensure that all scanned documents are clear and legible, as unclear submissions may delay the processing of your application.

- Personal Identification Document

- NRIC (for Singapore Citizens)

- Passport, Blue NRIC and Re-entry Permit (for Singapore Permanent Residents)

- Passport and Employment Pass or Dependent Pass (for non-Singaporeans applying for part-time programme)

- Passport (for non-Singapore Citizens)

- Degree Scroll and Official Transcript from each University attended (with English translation if applicable)

- GMAT / GRE / SMU Admission Test Score Report

- IELTS / TOEFL (if your degree was not taught in English)

- Updated Résumé

- Personal Statement

- Two Referee Reports

Upon submission of your application, both referees will receive an auto-generated email with instructions to complete an online referee report. You may monitor the submission status of these reports via the Applicant Self Service portal.

For enquiries, or if you would like to speak with our Programme Advisor, please email us at mdse@smu.edu.sg.

Admission Requirements

- Good Bachelor's degree

- Good score in GMAT/GRE/SMU Admission Test*

- Good TOEFL or IELTS score (if your degree was not taught in English)

- Personal statement

- Updated resume

- Two references

- Admission interview

*Undergraduate CGPA may be used in place of GRE/GMAT/SMU Admission Test scores for the following applicants:

- SMU alumni with a CGPA of 3.0/4.0 or above, within five years of graduation

- NUS/NTU/SUTD/SUSS/SIT alumni with a CGPA of 3.5/5.0 or above, within five years of graduation

Note: Meeting the CGPA academic criteria listed above does not guarantee admission. You may be advised to submit a GMAT/GRE/SMU Admission Test score to strengthen your application.

The GMAT/GRE is recommended. However, if you have not taken either, you may consider the online SMU Admission Test, which comprises three components: verbal, numerical, and inductive reasoning.

Please click Fact Sheet for information on SMU Admission Test registration and test details.

If you intend to take the SMU Admission Test, please first complete the MDSE application and make a payment of S$125, in addition to the MDSE application fee of S$100. After payment, send an email with your full name, application number, and payment receipt to mdse@smu.edu.sg

Programme Fees

Fees | Amount | Comments |

|---|---|---|

| Application | S$100 (inclusive of GST) | Non-refundable |

| Registration/Deposit | • Singapore Citizens & Permanent Residents S$400 (inclusive of GST) + S$5000 • Foreigners S$500 (inclusive of GST) + S$5000 | Non-refundable |

| Tuition | S$54,500 (inclusive of GST) |

Scholarships and Financial Aid

Objective

The MDSE Merit Scholarships are awarded to individuals who have demonstrated academic excellence, and outstanding leadership qualities.

Benefits

Merit 1 is valued at S$8,000 (inclusive of GST).

Merit 2 is valued at S$4,000 (inclusive of GST).

Obligations

Recipients of the Merit Scholarships are expected to participate actively in the development of student life and alumni networks and enhance the MDSE’s programme outreach.

Eligibility Criteria

Outstanding applicants to the MDSE are eligible for the Merit Scholarships. The offer is conditional on matriculation into the MDSE, i.e., the scholarship awardee must matriculate into the programme in order for the scholarship to be disbursed. Deferment of studies beyond the financial year would render the scholarship award null and void.

Objective

The MDSE Diversity Scholarships are awarded to incentivise good applicants from countries that are underrepresented in the MSc of Data Science in Economics programme so as to increase diversity in our classrooms.

Benefits

The scholarship comprises a monetary award of S$8,000 (inclusive of GST).

Obligations

Recipients of SOE MDSE Diversity scholarships are expected to be good ambassadors, participate actively in the development of student life and alumni networks and enhance the MDSE’s programme outreach, especially to other potential applicants from their home country.

Eligibility Criteria

SOE Applicants with good academic backgrounds and who are citizens of countries that are underrepresented in the programme are eligible for the SOE MDSE Diversity Scholarship. The scholarship awardee must matriculate into the MDSE programme in order for the scholarship to be disbursed. Deferment of studies beyond the financial year would render the scholarship award null and void.

Benefits

The scholarship comprises a monetary award of S$8,000 (inclusive of GST).

Obligations

Recipients of the Industry Distinction Scholarship are expected to serve as role models for other students, actively support outreach efforts for the MDSE programme, and maintain good academic standing throughout their studies.

Eligibility Criteria

The Industry Distinction Scholarship is intended for experienced professionals who bring valuable industry insights to the MDSE classroom. Applicants should have at least three years of work experience in areas such as economics, finance, or related fields.

Benefits

The scholarship comprises a monetary award of S$8,000 (inclusive of GST).

Obligations

Recipients of the Women in Leadership Scholarship are expected to demonstrate continued leadership and initiative, and to maintain good academic standing throughout their studies. They should actively contribute to the MDSE community and support efforts to advance women in data science and economics. Recipients are also encouraged to engage in mentorship, outreach, or other activities that promote inclusion and inspire future leaders.

Eligibility Criteria

The Women in Leadership Scholarship is open to women applying to the MDSE programme who have demonstrated strong leadership potential and a commitment to advancing women in economics, finance, or related fields. Applicants should have a record of academic achievement and professional or community involvement that reflects leadership and initiative.

Benefits

Merit 1 is valued at S$10,000 (inclusive of GST).

Merit 2 is valued at S$6,000 (inclusive of GST).

Obligations

Recipients of the DSA Distinguished Alumni Scholarship are expected to maintain academic excellence and demonstrate continued leadership throughout their studies. They should also actively contribute to the MDSE community.

Eligibility Criteria

This DSA Distinguished Alumni Scholarship is awarded to SMU Data Science & Analytics (DSA) Second Major alumni who have demonstrated both academic excellence and outstanding leadership.

In addition to the discounts and scholarships mentioned above, students may further subsidise their tuition fees through various financing options:

- SkillsFuture Funding (Singapore Citizens) Click on this link for more details.

- The SkillsFuture Level-Up Programme provides Singapore Citizens aged 40 years and above the opportunity to receive the SkillsFuture Credit (Mid-Career) top up of $4,000. This credit is intended to offset out-of-pocket tuition fees, starting from Academic Year 2024/25 intake, commencing on or after 1 May 2024. Please visit https://www.skillsfuture.gov.sg/level-up-programme.

- Singapore Citizens with eligible Post Secondary Education Account (PSEA) may utilize balance funds for tuition fees. Click on this link for more details.

- Students may approach local banks directly to enquire about and apply for available study loan packages.

FAQ

The August intake starts in mid-August, and the January intake starts in the first week of January.

You may apply for a Leave of Absence (LOA), subject to approval by the MDSE programme.

Classes are scheduled on weekday evenings (from 7pm onwards), Saturday mornings, or Saturday afternoons. These timings have been chosen to accommodate the working schedules of our part-time students who are concurrently working and our full-time students who are engaged with industry attachments.

However, full-time students may have some weekday morning or afternoon classes (8.15am, 12pm or 3.30pm onwards) in their first term.

All students will have a dedicated career coach who will be assigned to them throughout the Master’s programme. Here are some of the types of support you can expect:

- Career Planning and Coaching

- Internship and Job Search

- Resume and Cover Letter Critique

- Interview Preparation

- Administration of Personality Inventories

- Recruitment and Networking Events

- Career Development Workshops

You can use SMU’s internal online job portal to search and apply for internships and jobs. In addition, our career coaches maintain close connections with industry partners to source opportunities on an ongoing basis.